Keeping up with ETFs and mutual funds used to mean wading through dense analyst reports and financial news. Now, a different approach is taking hold.

The latest tools for understanding these investments are educational platforms that specialize in clear, practical lessons. These services break down complex fund strategies into manageable pieces, turning market trends from abstract concepts into understandable insights.

For anyone looking at the 2025 market, this shift is significant. The rise of active ETFs, the integration of digital assets, and the evolution of mutual funds are more than just headlines. They represent new ways to build and manage a portfolio.

This article looks at platforms that excel at teaching these specific areas. They provide the foundational knowledge needed to navigate current investment trends with significantly more confidence.

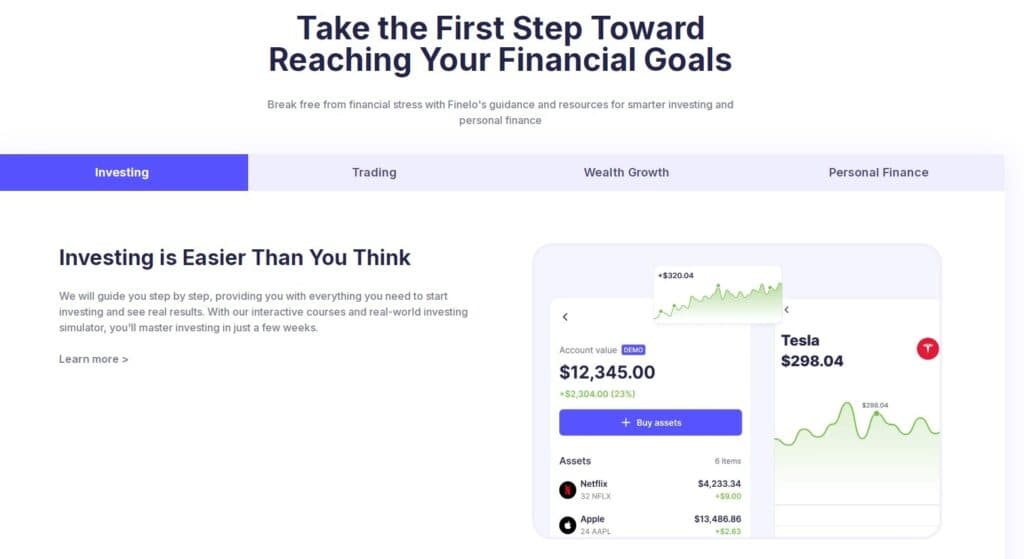

Finelo: The Practice-First Learning Ground

Finelo built its entire environment around people who find finance intimidating. The platform walks you through financial markets with a focus on direct application. You get access to a massive library of content that breaks down everything from cryptocurrency to retirement planning.

A custom plan forms when you first log in, shaping itself to what you already know and how quickly you pick things up.

Everything on Finelo.com connects back to its live trading simulator. This feature acts as a financial safety net, letting you place trades and test ideas with real-world data but no actual cash.

You can interact with charts and choose from a wide selection of stocks and assets. Putting a lesson into practice right away makes the concepts stick far better than just reading about them.

Best for: Absolute beginners who feel overwhelmed and need a risk-free environment to build foundational confidence before committing real capital.

Key Differentiator: Its deeply integrated simulator. Unlike platforms that just teach theory, Finelo’s practice environment is central to the learning experience, making it the closest thing to a “flight simulator” for investing.

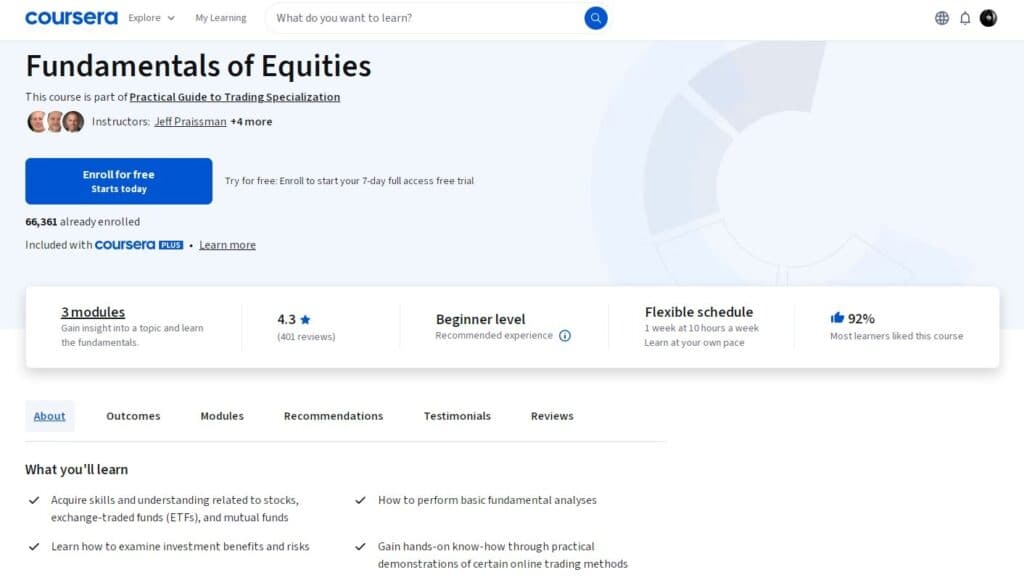

Coursera: The University in Your Browser

Coursera connects your screen directly to university classrooms. Its catalog holds a wide spectrum of finance material, from a simple ETF explainer to an entire graduate program. These courses come from places like Yale and the University of Illinois.

You will find a familiar structure of video lessons, assigned reading, and tests that determine your final grade.

The value here sits in the weight a Coursera certificate carries. These programs build skills that employers recognize immediately. You are signing up for a deep, methodical education, not a handful of quick market tips.

Best for: Career-focused learners and those who value formal credentials from recognized institutions to advance their professional profile.

Key Differentiator: The direct academic partnership model. Coursera provides actual university credit and degrees, setting it apart as a source of credentialed, academically rigorous financial education.

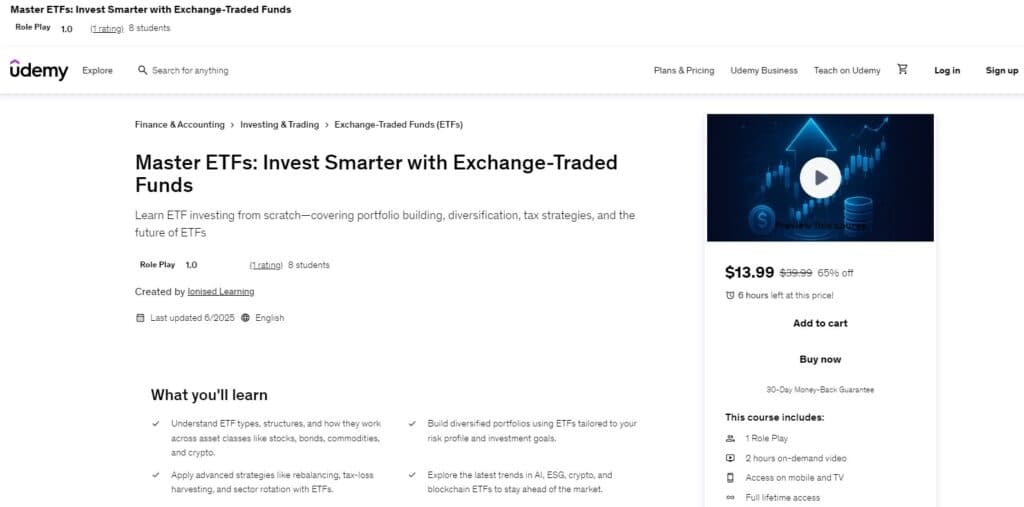

Udemy: The Skill-Specific Marketplace

Udemy works like a bustling open market for knowledge. Independent experts build and publish their own courses on every topic you can imagine, including very specific ETF tactics. The platform’s main advantage is its speed and focus. A search can pull up a short primer on ETF trading or an extensive workshop on advanced options, and you can be watching the first video moments later.

The model creates a wide variation in course quality, but it allows for learning directly from practicing traders and financial analysts. With frequent, deep discounts, it’s a low-cost way to acquire a very specific skill set without committing to a long-term subscription or multi-week program.

Best for: Someone who needs a fast, low-cost answer to a specific investing question, taught by a person who does the work.

Key Differentiator: You pick exactly what you need from a practicing expert. Udemy focuses on the specific skill you want right now, skipping the standardized syllabus.

BlackRock iShares: The Authority on ETF Education

BlackRock, the company that created iShares, offers what might be the most direct ETF education available. Its “EXCHANGE-TRADED FUNDS COURSE” lays out a clear path from basic definitions to actually placing ETFs in a portfolio. It walks you through the essentials: what an ETF is, how to judge a good one, and the mechanics of putting your money in.

The information comes in a series of connected modules. This material sticks to the facts, detailing how ETFs work, their advantages, and important details like fees. You move through the topics in a logical order, each new idea preparing you for the next.

Best for: Investors seeking a formal, step-by-step learning path from the world’s largest ETF provider.

Key Differentiator: It is the official, authoritative curriculum from the source that creates these products, offering a level of foundational credibility that third-party platforms cannot replicate.

The Learning Ladder: Matching Your Stage to the Right Platform

Choosing an educational tool often feels more confusing than the investing itself. The key is to match the platform to your current experience level. Think of it as a ladder.

On the first rung, you have foundational knowledge. This is where BlackRock iShares operates. It answers the “what” from an unimpeachable source. You learn what an ETF is, how it differs from a mutual fund, and why costs matter, straight from the company that built them.

The next rung is practical application. Udemy sits here. Once you know the definitions, you might take a course on building a monthly income portfolio with dividend ETFs. You learn the “how-to” from an instructor who has done it.

The third rung is structured, credentialed knowledge. This is the domain of Coursera. Here, you’re not just learning about ETFs; you’re taking a university course on the entire global financial system, with ETFs as one component. This is for building a career or a deep, academic understanding.

At the base of this entire ladder is Finelo. It is the practice yard where you build the muscle memory for climbing. Its simulator lets you test the theories you learn elsewhere without the consequence of a misstep. It provides the foundational confidence that makes engaging with the other platforms less intimidating. You learn the “feel” of the market before you ever risk a dollar.

Final Thoughts

Each platform in this ecosystem serves a specific need. BlackRock iShares offers authoritative foundational knowledge directly from the source. Coursera provides academic depth and career credentials. Udemy delivers immediate, tactical skills for specific goals.

If you are new to ETFs and mutual funds, Finelo offers the most straightforward starting point. Its combination of short lessons and a live trading simulator tackles a major problem for beginners: being nervous to use their own money.

You build a base level of self-assurance, which makes the complex topics on other sites seem less intimidating. A good learning tool does more than share facts; it builds your ability, and Finelo’s focus on doing makes that happen.